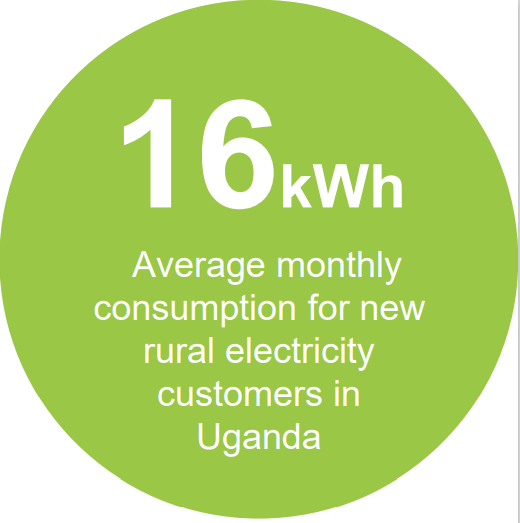

Newly electrified communities in Africa do not have access to income generating or livelihood improving electrical appliances that would make them economically viable to energy providers

This means that communities rarely exploit productive energy and, consequently, energy access initiatives are seldom bankable